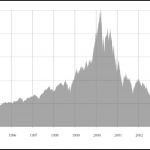

The formation of asset bubbles is one of the most attractive and perilous episodes in the financial markets. Bubbles seem to be inevitable only in retrospect. The identification of asset bubbles as they are built remains the most problematic part, even for seasoned economists and investors. The hype keeps many who are not able or …

Continue reading “Why Market Bubbles Are Hard to Identify Early”