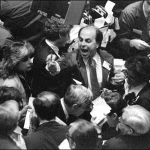

The stock market of the United States has always been considered an essential tool for the development of personal wealth and the planning of retirement. In the last ten years, many people in the USA have become investors in the stock market because of the possibility of investing online, the growth of 401(k) plans, and …

Continue reading “How Many Americans Invest in the Stock Market”